Building an Inclusive Financial Sector in China

UNDP,April 10, 2020 Adjust font size:

The Challenge

After over a decade of experiments in microcredit, access to finance is increasingly recognised as an important tool for development and poverty alleviation in China. However, competitive pressures are prompting the big banks to focus on cities. Extending access to finance in rural areas is therefore a high priority for the country's leadership. Several initiatives recently launched by government to test out new forms of rural financial service providers constitute good steps forward, but policy development needs better coordination and responsiveness to the needs of practitioners in order to reduce policy contradictions, uncertainty and obstacles.

The Response

The project Building an Inclusive Financial Sector in China aims to help put in place an enabling national policy and regulatory environment that fully meets practitioners’ needs to create a vibrant rural microfinance sector, through policy studies and consultations. It further seeks to catalyse the creation of new types of rural financial institutions that serve poor and low-income clients by combining commercial objectives with social ones, through local policy and practice innovations.

The project will also investigate the feasibility of financing UNDP’s other ongoing or previous poverty reduction initiatives using such mechanisms.

Achievements

Since the inception of the project in 2009, policy research on promoting the inclusion of financial services have been conducted, and initial policy consultations were held with People’s Bank of China. The project was revised in 2011 as local commercial banks were introduced to the project's parameters.

A series of policy studies on promoting the inclusion of financial services were conducted, investigating issues such as social performance evaluation of commercial banks and evaluation of methodology and modules on micro-finance indicators. An Index of Micro and Small Enterprises Development and a Credit Rating System for Microfinance Institutions have been developed.

With the support of the project, Harbin Bank has taken the lead in conducting trainings for China’s microfinance institutions on social performance management, helping them create their own sustainable development-orientated businesses. Building on past achievements and experiences, 2013 sees innovative micro-finance models being explored and piloted in Yilong county and Guang’an county in Sichuan, and Danzhai county in Guizhou.

Who finances it?

Programme Overview

Start Date:

2008

Estimated End Date:

2018

Location(s):

Beijing, Baotou, Harbin

Focus Area:

Poverty Reduction

Project Officer:

Ms. Pei Hongye

Total Budget:

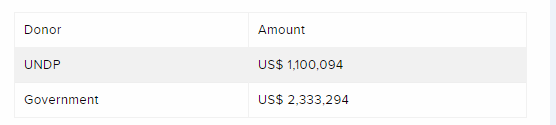

US$ 3,433,388

Donors:

UNDP; Government

Partners:

China International Center for Economic and Technical Exchanges(CICETE)

Start Date:

2008

Estimated End Date:

2018

Location(s):

Beijing, Baotou, Harbin

Focus Area:

Poverty Reduction

Project Officer:

Ms. Pei Hongye

Total Budget:

US$ 3,433,388

Donors:

UNDP; Government

Partners:

China International Center for Economic and Technical Exchanges(CICETE)

![]() Building an Inclusive Financial Sector in China.pdf

Building an Inclusive Financial Sector in China.pdf